May 24, 2022

Equipment Breakdown Coverage Goes Beyond Insurance

Equipment Breakdown insurance — formerly called Boiler & Machinery insurance — covers much more than boilers and machinery.

Insurers introduced boiler and machinery coverage in the mid-1800s to cover valuable steam-powered machinery from explosion or breakdown, and to cover the equipment’s owner from liability for resulting property damage or bodily injury. Today, few businesses use steam-powered machinery for business operations, but some still use steam-powered equipment for generating heat or power. Many states require these boilers to be inspected annually.

If your boilers fall into this category, you may find equipment breakdown coverage a bargain, as coverage includes an inspection by the insurer along with protection from loss due to property damage or bodily injury. This is actually the component of your insurance premium because the mechanical breakdown inspections are quite thorough and will typically reveal any problems that exist, which once corrected, means that you are unlikely to experience a loss during the policy period.

To prevent business shutdowns or slowdowns, an organization might want to cover other kinds of valuable equipment from mechanical breakdown, too. In addition to boilers, today’s equipment breakdown insurance can cover these types of equipment:

- Equipment designed to operate under internal pressure or vacuum

- Equipment designed to generate, transmit or use energy

- Communications equipment and computers

- Equipment owned by a utility and used to provide service to an insured’s location.

Don’t think you need this coverage? Consider the following examples of claims from Hartford Steam Boiler, an insurer that specializes in boiler and machinery insurance and equipment breakdown insurance:

- Owners of an office building had to spend nearly $1.6 million to restore power to tenants — including an accounting firm on tax-season deadlines—after electrical arcing destroyed three electrical panels, leaving the building without power.

- A medical clinic had to discard more than $21,000 worth of drugs when they froze after a controller on its refrigerator malfunctioned.

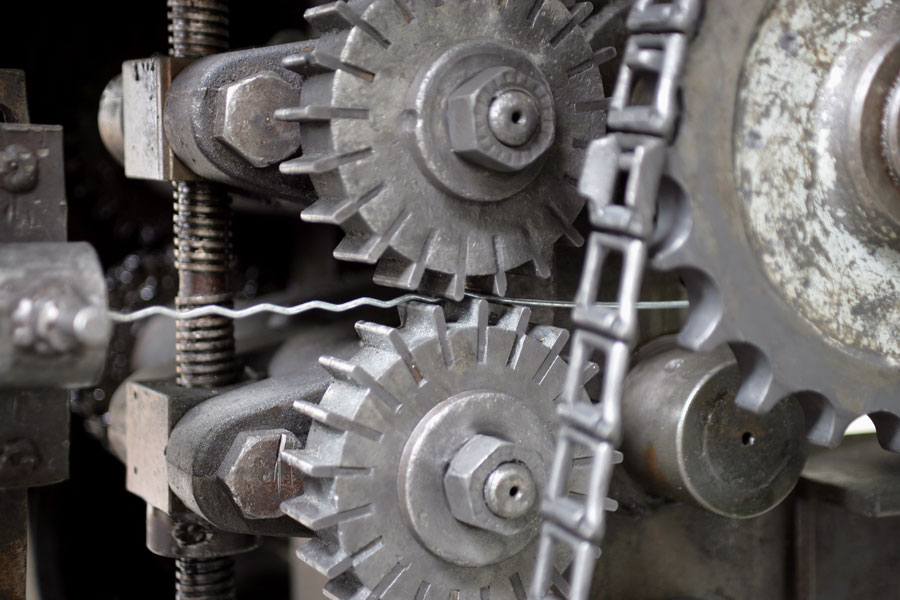

- A printer spent more than $136,000 to repair a high-speed press after a bolt came loose and jammed the cylinder and gears.

Insurers typically write equipment breakdown coverage under a stand-alone policy; however, some will include the coverage under highly protected risks (HPR) policies or in business package policies. Most policies provide seven typical coverages.

Equipment breakdown policies are designed to cover your equipment from mechanical failure only, so they typically exclude damage from earth movement, flood, nuclear hazard, windstorm or hail. They also exclude “causes of loss” typically covered by other property policies, such as aircraft, vehicles, freezing, lightning and vandalism. Many other exclusions apply; however, you can modify many of these by adding an endorsement to your policy.

Equipment breakdown coverage is highly specialized and should be handled by an experienced broker. For more information on equipment breakdown coverage, please contact us.